All Categories

Featured

Table of Contents

While numerous life insurance policy products need a medical examination, last expenditure insurance coverage does not. When obtaining final cost insurance policy, all you need to do is respond to several questions concerning your wellness. 2 With final expenditure insurance policy, costs are secured in when you get authorized. 3 They'll never enhance as long as your policy stays energetic.

If you're older and not in the finest wellness, you might notice higher premiums for last expenditure insurance policy. Prior to you dedicate to a last expense insurance plan, take into consideration these elements: Are you simply looking to cover your funeral service and funeral expenses? If so, last expense insurance policy is likely an excellent fit.

If you would certainly like sufficient protection without breaking the financial institution, last expense insurance coverage might be worthwhile. If you're not in terrific health, you may want to avoid the medical exam to get life insurance policy coverage. In this instance, it might be wise to take into consideration last expenditure insurance coverage. Last cost insurance coverage can be a terrific method to aid shield your enjoyed ones with a little payout upon your fatality.

Final Expense Insurance Agents

Insurance coverage amount chosen will certainly be the very same for all covered children and may not go beyond the face quantity of the base policy. Problem ages begin at 30 days via less than 18 years old. Policy becomes exchangeable to an entire life policy in between the ages of 22 to 25. A handful of variables affect just how much last cost life insurance policy you absolutely need.

They can be used on anything and are created to assist the beneficiaries stay clear of a monetary crisis when a liked one passes. Funds are usually utilized to cover funeral expenses, medical expenses, repaying a home loan, automobile car loans, and even made use of as a savings for a brand-new home. If you have adequate savings to cover your end-of-life costs, then you might not require final cost insurance.

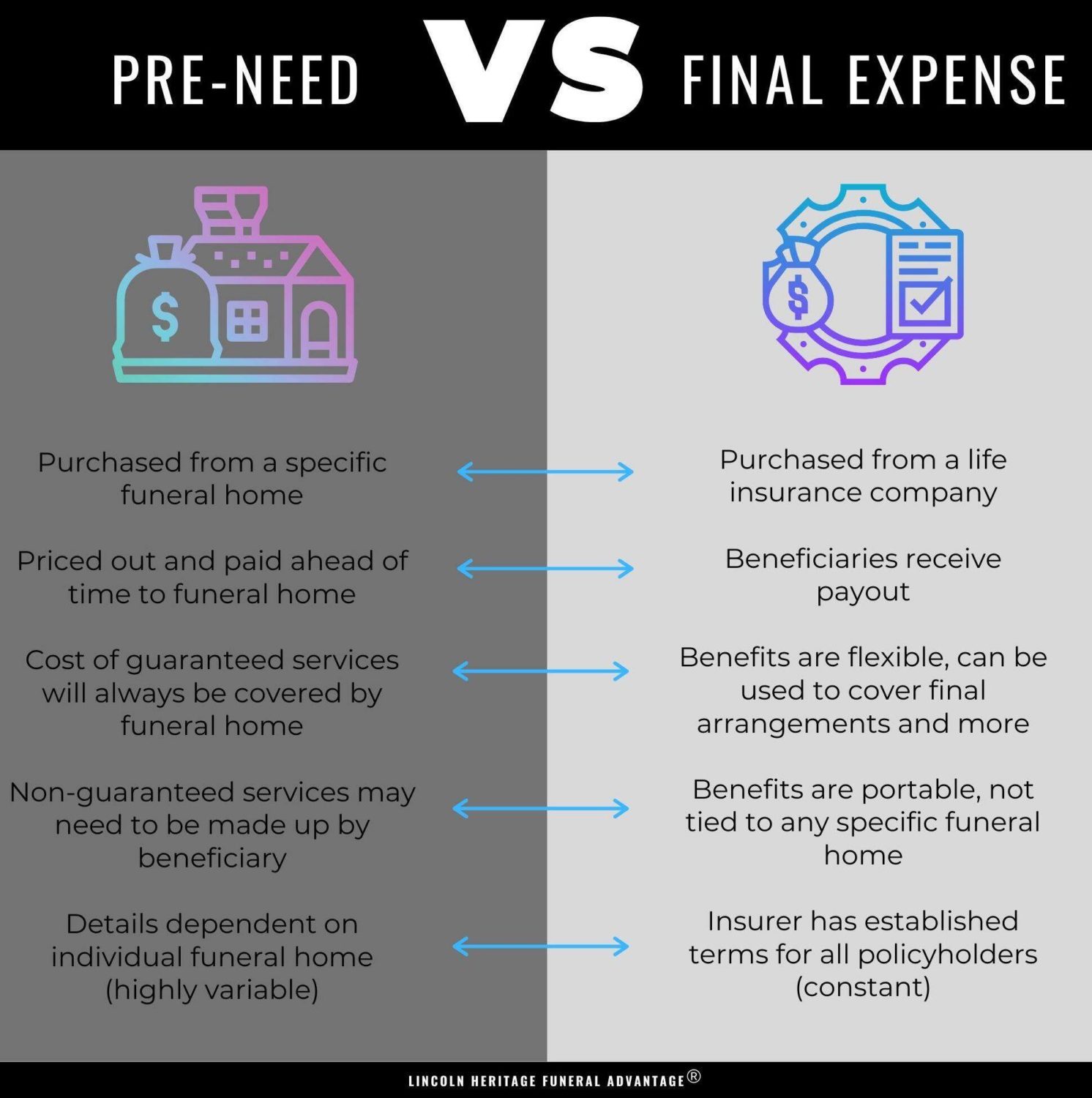

Additionally, if you've been not able to get approved for bigger life insurance policy policies because of age or medical conditions, a last expense policy might be a cost effective choice that minimizes the worry positioned on your family when you pass. Yes. Last cost life insurance policy is not the only way to cover your end-of-life prices.

These generally provide higher coverage quantities and can protect your household's way of living along with cover your last expenses. Related: Whole life insurance policy for senior citizens.

They are generally released to candidates with one or even more health and wellness problems or if the applicant is taking particular prescriptions. If the insured passes throughout this duration, the recipient will generally receive every one of the costs paid into the policy plus a little additional percentage. An additional last expense choice used by some life insurance policy business are 10-year or 20-year plans that offer applicants the alternative of paying their policy completely within a particular amount of time.

Cheapest Funeral Policy

The most important thing you can do is answer inquiries honestly when obtaining end-of-life insurance. Anything you keep or conceal can create your benefit to be denied when your family members needs it most. Some individuals believe that because a lot of last cost policies do not call for a medical test they can lie regarding their health and the insurance provider will certainly never ever know.

Share your last wishes with them also (what flowers you might desire, what flows you want reviewed, tracks you want played, and so on). Documenting these beforehand will save your loved ones a great deal of stress and anxiety and will certainly prevent them from attempting to guess what you wanted. Funeral prices are climbing regularly and your health and wellness could transform instantly as you obtain older.

The primary recipient obtains 100% of the death benefit when the insured dies. If the primary beneficiary passes prior to the insured, the contingent receives the advantage.

Always inform your life insurance policy business of any kind of adjustment of address or phone number so they can update their documents. Lots of states permit you to pre-pay for your funeral.

The death advantage is paid to the primary beneficiary once the insurance claim is authorized. It depends on the insurance coverage company.

Final Expense Life Insurance Quotes

If you do any kind of kind of funeral planning ahead of time, you can document your last want your key beneficiary and show how much of the plan advantage you want to go in the direction of last arrangements. The procedure is usually the same at every age. Most insurance firms need a private be at least thirty days of age to request life insurance policy.

Some firms can take weeks or months to pay the policy benefit. Others, like Lincoln Heritage, pay approved insurance claims in 24-hour. It's tough to claim what the average costs will certainly be. Your insurance coverage price depends on your health and wellness, age, sex, and just how much protection you're obtaining. A good price quote is anywhere from $40-$60 a month for a $5,000 $10,000 plan.

Tobacco rates are greater no matter what kind of life insurance coverage you take out. Final expense insurance raises a financial burden from families grieving the loss of a person they love.

Final expenditure insurance has a death advantage developed to cover expenditures such as a funeral or funeral, embalming and a casket, or cremation. Beneficiaries can use the fatality advantage for any purpose, from paying residential property taxes to taking a holiday. "They market the final cost insurance policy to people that are older and starting to consider their funeral expenses, and they make it appear like they need to do it in order to take care of their household," says Sabo.

Last expense insurance policy is a small entire life insurance policy plan that is very easy to certify for. The recipients of a last cost life insurance policy policy can make use of the plan's payment to pay for a funeral solution, coffin or cremation, medical bills, taking care of home costs, an obituary, flowers, and a lot more. The fatality benefit can be utilized for any kind of objective whatsoever.

When you get final expenditure insurance policy, you will certainly not need to handle a clinical examination or let the insurer gain access to your medical documents. Nonetheless, you will certainly need to answer some health inquiries. Due to the health questions, not everyone will certainly get a plan with coverage that starts on day one.

Does Life Insurance Pay For Funeral Expenses

The older and less healthy you are, the greater your prices will be for a given quantity of insurance. Male tend to pay greater prices than females since of their much shorter ordinary life span. And, relying on the insurer, you may receive a reduced rate if you do not use cigarette.

Nonetheless, depending upon the policy and the insurance firm, there may be a minimum age (such as 45) and maximum age (such as 85) at which you can apply. The largest fatality benefit you can pick may be smaller the older you are. Policies might go up to $50,000 as long as you're younger than 55 but only go up to $25,000 once you turn 76.

Allow's claim you're retired, no longer live insurance policy through your employer, and do not have a private life insurance policy plan. Neither do you have a savings huge enough to relieve the financial problem on your spouse and/or youngsters when you die. You're thinking about a brand-new life insurance policy. You contact a life insurance policy representative and begin the application process.

Table of Contents

Latest Posts

Life Insurance Burial Expenses

Insurance Funeral Cover

Canadian Final Expense Plan

More

Latest Posts

Life Insurance Burial Expenses

Insurance Funeral Cover

Canadian Final Expense Plan