All Categories

Featured

Table of Contents

Life insurance representatives market home mortgage defense and lending institutions sell mortgage protection insurance coverage, at some point. mpi insurance near me. Below are the 2 kinds of representatives that offer home loan defense (mortgage protection unemployment insurance).

Getting mortgage defense with your lending institution is not always a very easy task, and typically times fairly complicated. Lenders typically do not sell home loan protection that profits you.

Mortgage Protection Online

The letters you receive appear to be coming from your lender, yet they are simply originating from 3rd party companies. mortgage insurance companies. If you don't wind up obtaining typical mortgage defense insurance coverage, there are other kinds of insurance policy you may been needed to have or could wish to consider to protect your investment: If you have a home mortgage, it will be needed

Especially, you will want house coverage, contents insurance coverage and individual responsibility. compare mortgage protection insurance quotes. Additionally, you ought to take into consideration adding optional insurance coverage such as flood insurance, quake insurance, replacement cost plus, water backup of sewer, and other structures insurance for this such as a gazebo, dropped or unattached garage. Just as it sounds, fire insurance coverage is a kind of residential or commercial property insurance coverage that covers damage and losses caused by fire

This is the main option to MPI insurance policy. Whole life is a permanent plan that is extra expensive than term insurance policy yet lasts throughout your whole life.

Coverage is usually limited to $25,000 or less, yet it does shield versus having to tap various other financial resources when a person dies (insured mortgages). Last expense life insurance coverage can be used to cover medical prices and various other end-of-life expenditures, consisting of funeral and burial expenses. It is a kind of permanent life insurance policy that does not end, but it is an extra expensive that term life insurance policy

Mortgage Insurance No Medical

Some funeral homes will approve the task of a last expense life insurance policy policy and some will not. Some funeral chapels call for settlement in advance and will certainly not wait till the final expense life insurance policy policy pays. It is best to take this right into factor to consider when dealing when taking into consideration a last expense in.

Benefit settlements are not assessable for income tax obligation purposes. You have a number of options when it pertains to buying mortgage defense insurance policy (mortgage insurance benefits). Several business are very ranked by A.M. Ideal, and will certainly offer you the included self-confidence that you are making the appropriate decision when you purchase a plan. Among these, from our perspective and experience, we have actually found the complying with firms to be "the very best of the finest" when it comes to issuing home loan defense insurance coverage, and advise any kind of one of them if they are choices offered to you by your insurance coverage representative or mortgage loan provider.

Mortgage Protection Insurance In Case Of Death

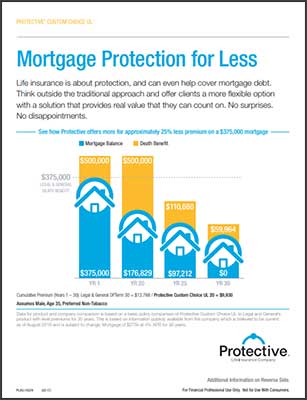

Functioning closely with an insurance policy expert will certainly provide you with the essential information you require to make the appropriate decision. mortgage plan protection. Can you get mortgage security insurance coverage for homes over $500,000? Yes. The greatest distinction between home mortgage defense insurance policy for homes over $500,000 and homes under $500,000 is the requirement of a medical exam.

Every company is various, yet that is a good general rule. Keeping that stated, there are a couple of companies that provide home loan security insurance up to $1 million without clinical tests. what is mortgage repayment insurance. If you're home is worth less than $500,000, it's highly most likely you'll get approved for strategy that doesn't require medical exams

Mortgage protection for reduced revenue real estate usually isn't needed as most low income housing devices are rented and not had by the owner. The owner of the units can definitely acquire mortgage defense for low revenue real estate device tenants if the policy is structured correctly. In order to do so, the residential property proprietor would certainly require to collaborate with an independent agent than can structure a team plan which enables them to settle the passengers on one plan.

If you have inquiries, we very suggest talking with Drew Gurley from Redbird Advisors. Drew Gurley belongs to the Forbes Finance Council and has actually worked some of one of the most one-of-a-kind and varied home loan security plans - mortgage life insurance calculator uk. He can certainly assist you believe via what is needed to place this type of strategy with each other

Takes the guesswork out of safeguarding your home if you pass away or end up being handicapped. Eliminates the emotions and anxiety associated with getting a huge lump sum repayment and possibly mishandling it. Money goes straight to the home loan firm when an advantage is paid out. It is fairly inexpensive. It usually includes a guaranteed concern clause, indicating no clinical examination is called for - life insurance for mortgage protection.

Table of Contents

Latest Posts

Life Insurance Burial Expenses

Insurance Funeral Cover

Canadian Final Expense Plan

More

Latest Posts

Life Insurance Burial Expenses

Insurance Funeral Cover

Canadian Final Expense Plan